In July 2025, Congress passed a huge new tax law—nicknamed “The One, Big, Beautiful Bill”—that changes the game for small businesses. It’s a coupon book for service businesses to qualify for. A godsend for those toiling and have Time In Business (TIB). If you own a construction company, work as a general contractor, or manage a small crew specialising in HVAC, plumbing, electrical, roofing, or landscaping services, this new bill could significantly benefit your bottom line.

In plain English, it puts more cash in your pocket—especially if you’re buying or leasing equipment or borrowing money to keep your business running smoothly.

Let’s break it down into simple parts.

1. You Can Now Deduct 100% of Equipment Costs | Section 179 Just Got Bigger

What Changed? Buy a Machine → Deduct It All at Once

Another vital part of the tax code is Section 179, which allows you to deduct the full price of equipment or software you purchase and use for business purposes.

Under the old tax rules, if you bought a machine—like a skid steer, backhoe, dump truck, or trailer—you could only deduct 40% of the cost in the first year (in 2025). The rest had to be written off slowly over time.

Now, with this new bill, you can deduct 100% of the purchase price right away, as long as you buy it after January 19, 2025, and start using it before January 1, 2030. This applies whether the equipment is new or used.

This tax break is called bonus depreciation, and it’s now back in full effect.

Why It Matters

In the past, you could write off up to $1.25 million worth of gear, and this would start to phase out if you bought more than $3.13 million in total.

Now, the cap has doubled to $2.5 million, and the phase-out starts at $4 million.

This means that mid-sized construction companies or fast-growing crews that purchase multiple machines, trucks, or trailers in a year will still be able to write off the entire amount.

Let’s say you buy a $250,000 excavator this year. Under the old rules, you’d only be able to write off $100,000 in 2025. That would save you about $30,000 in taxes (assuming a 30% tax rate). But the other $150,000 would get spread out over several years.

Now, with the new rule, you get to deduct the full $250,000 this year—saving you $75,000 in taxes immediately. That’s like getting a giant tax refund or avoiding a hefty tax bill.

Who Wins?

Contractors buying equipment outright

Businesses financing equipment with a loan or lease

Anyone needing more tax deductions this year

2. Buying vs. Leasing: Level Playing Field

In the past, leasing equipment often provided contractors with a larger tax break because lease payments were fully deductible. Now, thanks to 100% bonus depreciation and the higher Section 179 cap, buying can be just as good—if not better.

Now you can make decisions based on what works best for your cash flow, interest rate, and resale value—not just on tax write-offs.

So, whether you’re financing through a dealer, bank, or equipment finance company, you can make smarter decisions.

🛠 Take‑away: Owning equipment is now just as tax‑friendly as leasing (leases were already fully deductible). We help pick the structure that gives you the best rate, terms, and resale upside rather than chasing tax breaks.

3. You Can Deduct More Loan Interest

What Changed? Borrow → Deduct More Interest

If you’ve ever borrowed money—like a term loan for equipment or a revolving line of credit for payroll—you know interest adds up. And not all of it was deductible under the old rules.

Before this bill, your ability to deduct interest was limited to 30% of EBIT (earnings before interest and taxes). That cap didn’t include depreciation or amortisation, which made it harder for heavy equipment users to deduct their interest.

Now, the 30% limit is based on EBITDA (earnings before interest, taxes, depreciation, and amortisation), which is a bigger number. That means your deduction limit is higher, and you can write off more of your loan interest.

Example

If you took out a $400,000 equipment loan at 8% interest, that’s about $25,600 in interest in year one. Under the old rules, some or all of that interest might have been disallowed depending on your income.

With the new rule, it’s much more likely that you can deduct the full $25,600—lowering your taxes even more.

🛠 Take‑away: If interest write‑offs were choking you, they probably won’t anymore. That can improve debt‑service‑coverage ratios we use when we talk to banks or equipment‑finance firms on your behalf.

4. More Cash Flow with the Pass-Through Deduction

Suppose your business is an S-Corp, LLC, partnership, or even a sole proprietorship. In that case, you might already know about the 20% pass-through deduction created in 2017.

That rule lets you deduct 20% of your business income before paying personal income taxes.

Now, the deduction is 23% and it’s permanent.

That might not sound like a huge jump, but here’s what it means in real numbers:

If your business makes $200,000 in profit, the deduction used to be $40,000.

Now it’s $46,000.

That means you pay personal income tax on only $154,000 instead of the full $200,000.

Those savings could be several thousand dollars per year, depending on your tax bracket.

🛠 Take‑away: 23 % pass‑through deduction (up from 20 %) is now permanent for S‑corps, partnerships, and sole props. That lowers owners’ taxable income, freeing up more cash to self‑fund projects or cover payroll gaps.

5. Less Paperwork and Red Tape

A smaller part of the bill also raised the reporting limits for 1099 forms.

You don’t have to send (or receive) a 1099-NEC unless you pay someone over $1,000 (up from $600).

1099-K incoming thresholds for third-party payments (like Venmo, Zelle, PayPal) went up to $10,000.

This reduces headaches at tax time and gives your bookkeeper fewer forms to chase down.

6. Real-World Example: How This Helps a Contractor

Putting It Together — A Quick Example

Let’s say you’re a contractor buying a used excavator for $400,000 in August 2025. You finance 80% of it through an equipment lender at an 8% interest rate.

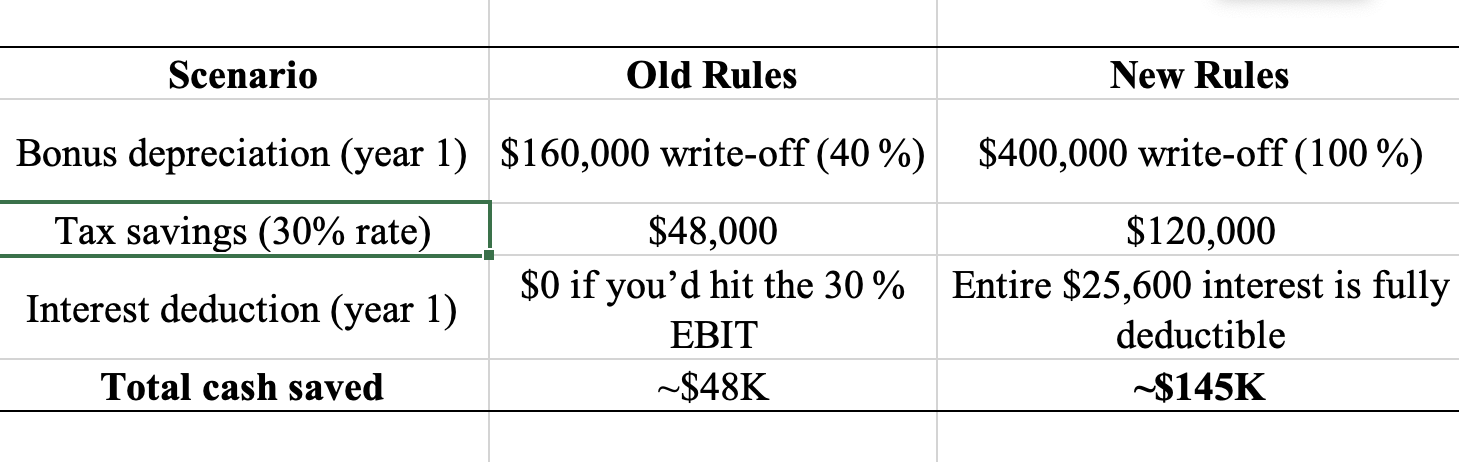

Here’s what it looks like before and after The Big, Beautiful Bill:

That’s nearly $100,000 more in tax benefits in one year, just from the timing of your purchase and the new rules. Net effect: About +$97 k more cash stays in your business the first year.

That money could:

Cover payroll for a slow winter

Pay for materials upfront on a new job

Help you hire an extra worker

Pay down the loan faster

7. What Should You Do Next? (Checklist)

Here’s what every contractor or construction business owner should do now that this bill is law:

✅ Update your equipment buying plan

If you were putting off a purchase, now’s the time to reconsider. You may be able to write off the full cost this year.

✅ Compare lease vs. buy

Leasing no longer offers a significant tax advantage over buying. Look at the whole picture—cash flow, interest rates, and resale value.

✅ Talk to your CPA

Have a strategy session with your tax advisor to make sure you’re timing purchases correctly and taking the right deductions.

✅ Adjust estimated taxes

Bigger write-offs might lower what you owe the IRS this year. That means you can lower your quarterly payments and keep more cash.

✅ Refinance or use more working capital loans

If you’ve been holding back on borrowing because you couldn’t deduct the interest, you may now be in a better position. Rerun the numbers with your lender.

✅ Recalculate your debt service coverage ratio (DSCR)

Many lenders use EBITDA when deciding how much they’ll lend. With more deductible interest, your DSCR may look better than you thought.

Final Thoughts: Why This Bill Matters to Contractors

The 2025 “One, Big, Beautiful Bill” was designed to help small businesses grow—and construction businesses are in a great spot to benefit.

Whether you’re buying a trailer, backhoe, or skid steer—or taking a line of credit to fund payroll between jobs—the tax rules are now working in your favour.

You get:

More up-front deductions

Higher loan interest write-offs

Bigger pass-through savings

Simpler paperwork

Stronger cash flow

For contractors, this means more flexibility, more options, and less stress during both busy and slow seasons.

1. Permanent 100 % Expensing: No More Sunset Jitters

What’s new: The bill makes “bonus depreciation” permanent instead of letting it ratchet down after 2025. You can write off the entire cost of gear, shop tools, trailers, or even a prefab metal building the same year you place it in service — forever, no phase‑out clock ticking. waysandmeans.house.gov

Why it matters to you: Locking this in gives banks and equipment‑finance companies confidence that future tax savings will still be there five or ten years from now, so they’re more willing to stretch amortisation or offer skip‑payment schedules that match your slow season.

2. Section 179 Doubles (and Stays Doubled)

Section 179 expensing now caps out at $2.5 million each year and doesn’t start phasing out until total purchases hit $4 million. The language says that the limit “shall be adjusted for inflation,” so it won’t quietly shrink in real terms. waysandmeans.house.gov

Quick math: A medium‑size civil contractor could buy three new dump trucks, two mini‑excavators, and a GPS rover kit without tripping the cap.

3. Permanent Interest‑Deduction Fix

Interest write‑offs tied to EBITDA (instead of EBIT) are also made permanent — no 2029 sunset. That’s especially helpful if you finance big‑ticket machinery or keep a revolving line for payroll and materials. waysandmeans.house.gov

4. Extra Perks for Rural & Ag Contractors

Suppose you build grain bins, install tile, or do custom dirt work for farmers. In that case, the “Makes Rural America Great Again” section offers extras:

Death‑tax relief stays doubled, so family‑owned farms keep spending on barns, pivots, and land‑levelling instead of liquidating to pay estate tax. waysandmeans.house.gov

The 20 % pass‑through deduction (Section 199A) is locked in, and Section 179’s higher threshold is highlighted because one‑fifth of all 179 write‑offs come from agriculture. waysandmeans.house.gov

5. Cheaper Payroll for Hourly Crews

The “Put American Workers First” sheet confirms that tips and overtime premiums get a zero income‑tax rate:

Up to $25,000 of tips per worker per year.

Up to $12,500 of OT premium per worker per year. waysandmeans.house.gov

That means you can advertise “keep more of what you earn” in help‑wanted ads, which may ease your labour shortage without raising hourly base pay.

6. 1099 Relief & Less Bookkeeping

Two different fact sheets single out paperwork roll‑backs:

The old gig‑worker 1099‑K rule (earning more than $600) is repealed. The new threshold is $1,000

The 1099‑MISC threshold rises to $2,000. waysandmeans.house.gov

If you sub out small welding jobs or pay a local trucker for a one‑off gravel haul, you’ll cut down on nuisance forms—and maybe on CPA bills.

7. Bigger Standard Deduction & Child Tax Credit Help Owners’ Personal Cash Flow

Yes, it’s personal‑side stuff, but it frees up money you can drop back into the business:

Standard deduction jumps to $31,500 for a married couple. waysandmeans.house.gov

Child Tax Credit bumps to $2,200 and is indexed for inflation. waysandmeans.house.gov

“Working‑class families under $50 000” get a 14.9 % tax cut overall. waysandmeans.house.gov

Less money to the IRS means a bigger cushion for slow months or a larger down payment on the next compact track loader.

8. No‑Tax‑on‑Car‑Loan‑Interest = Easier to Grow the Fleet

The workers’‑first sheet also lets families deduct all interest on auto loans for new U.S.‑made vehicles. waysandmeans.house.gov

If you give project managers or foremen a take‑home truck, structuring it as a personal auto loan could now beat a taxable company car allowance.

9. Opportunity Zones Re‑Charged (Good News for Storage‑Yard Expansions)

Opportunity Zones are renewed and steered toward rural and distressed areas. Contractors buying land for a new yard, shop, or prefab warehouse within a Zone can defer or cut capital gains taxes. waysandmeans.house.gov waysandmeans.house.gov

10. Manufacturing‑Building Bonus Depreciation

The “Fuels America’s Growth” sheet states that new manufacturing structures (such as concrete batch plants, truss shops, and prefab steel fabrication) qualify for immediate expensing, which boosts investment by 3.8%. waysandmeans.house.gov

Subs that fabricate rebar or trusses in‑house could build a new shop and write off the entire shell in year 1.

11. Who Doesn’t Get the Sweeteners?

The “Makes America Win Again” sheet highlights crack‑downs that don’t hurt traditional contractors but may matter at the margins:

Green‑energy subsidies and EV tax breaks are rolled back.

Non‑profits paying execs giant salaries lose special treatment. waysandmeans.house.gov

Unless you’re in large‑scale solar, this is background noise—but it does free up revenue for the expensing and interest‑deduction goodies you do like.

12. Big Picture Cash‑Flow Gains for a Mid‑Size Contractor

Combine everything above, and the numbers get eye‑popping:

Net result: Well over $200,000 in extra first‑year tax savings on the same $1 million investment, plus lighter paperwork and happier overtime employees.

🧭 13. What Happens & When – A Simple Breakdown

The Big Beautiful Bill doesn’t start all at once. Different parts go into effect at different times, depending on the topic. Here’s what you need to know:

💸 Tax Cuts (Start January 1, 2025)

You’ll notice these changes when you file your 2025 taxes in early 2026:

· No federal tax on tips or overtime (up to $25,000 in tips and $160,000 in OT, if you make under $150,000 total).

· Bigger child tax credit – $2,200 in 2025, going up to $2,500 later.

· Higher SALT deduction – You can deduct more of your state/local taxes.

· Interest on loans is more likely to be tax-deductible.

· Estate and gift tax exemptions get a boost (which helps if you’re passing on assets).

🛠 What It Means for You (Contractors especially)

Filing in 2026 (for 2025 income):

· You won’t pay federal tax on your tips or OT, up to the limits.

· You may get a bigger refund thanks to the child tax credit and new deductions.

· If you bought tools or a truck with a loan, interest might now be deductible.

🚧 Other Changes Coming Later

· Clean Energy Tax Credits End – EV, solar, and other green tax breaks end 60 days after the bill is signed, except for nuclear/hydro projects already started.

· Medicaid & Food Help (SNAP) – Work rules and funding changes start after January 1st, 2027. States will begin sharing more SNAP costs in 2028.

· New Savings Accounts & Child Tax Credit Boost – Begin with the 2025 tax year, but they end after 2028 unless renewed.

· Military & Border Spending – More money for defence, veterans, and border patrol kicks in during the 2026 federal budget year.

Action Items—Now That You Know More

Re‑price bids that assumed only 40 % depreciation. You have tax head‑room to lower margins and still net the same profits.

Ask lenders to re‑run covenants using EBITDA instead of EBIT—your coverage ratio just improved.

Map your next yard or fab shop against the refreshed Opportunity‑Zone list.

Rewrite help‑wanted ads to spotlight tax‑free OT and tip income.

Schedule a Q4 planning call with your CPA to juggle Section 179 vs. bonus depreciation for maximum bang.

Bottom line: The new details from the House fact sheets confirm that virtually every tax break a contractor cares about—faster equipment write‑offs, bigger interest deductions, lower payroll taxes on OT, and less 1099 paperwork—is either doubled, made permanent, or both. The sooner you realign your financing strategy to these rules, the greater your competitive edge in 2025 and beyond. For most construction firms, the One Big Beautiful Bill makes buying or financing equipment—and the associated borrowing costs—much cheaper after taxes. Use the extra cash to win more bids, staff up, or simply sleep better knowing your working capital cushion has just got thicker.

If you’re unsure how to take full advantage, ask your equipment finance partner or accountant for guidance. The sooner you act, the more you save.

Commercial Financing Now ® is a Money Service Business (MSB) operating as a Non-Bank Financial Institution (NBFI) that abides by Anti-Money Laundering (AML) Regulations. These policies and procedures are internally published and meet reporting requirements while considering sanctions screening and transactional monitoring.

Commercial Finance Now does not provide tax, legal, or accounting advice. This post has been drafted for informational purposes only and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. You should consult your tax, legal, and accounting advisors before considering any tax treatments.